Appendix 4C Sep Qtr and Activities Report - Stronger Earnings

MELBOURNE, AUSTRALIA, 24th October 2022: Beam Communications Holdings Ltd (ASX: BCC) is pleased to announce the Activities report and appendix 4C: On track to deliver strong earning in FY23

Highlights:

- Continued strong sales growth across all of Beam’s key products in the quarter

- Beam on track to deliver improved margins and EBITDA of >$2.1m for FY23 (+40% vs. FY22)

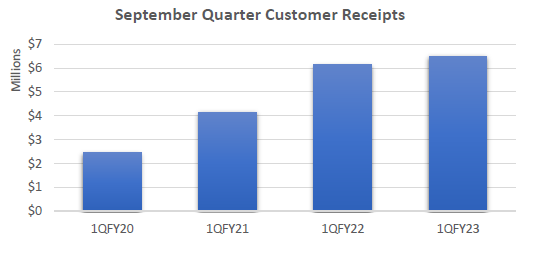

- Customer receipts up 5.6% pcp to $6.5m while Group sales hit ~$8m in 1QFY23

- Beam Equipment sales (ex ZOLEO) jumps 251% and SatPhone Shop revenue gains 70% in quarter vs. pcp

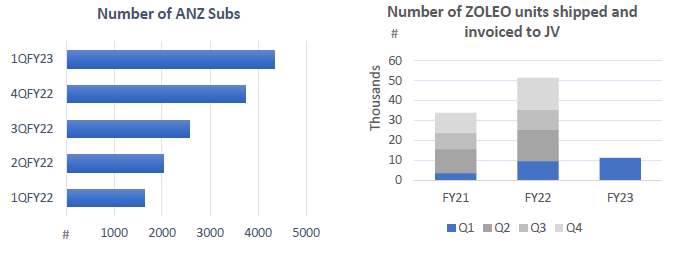

- ZOLEO ANZ subs up 165% pcp to 4,337 and annualised royalty payments up 11% over 4QFY22 to $760k

- Beam sufficiently resourced to execute its growth plans with total available funds of $4.9m

- Use of funds consistent with objectives outlined in Nov 2021 capital raise

Beam Communications Holdings Ltd (ASX: BCC, “Beam” or the “Company”) is pleased to provide its quarterly update and commentary on its Appendix 4C for the three months to 30 September 2022.

Beam confirms that it is on track to deliver materially stronger earnings and margins in the current financial year.

Summary of cash position

Beam recorded a 5.6% increase in quarterly receipts from customers to $6.5 million vs. the previous corresponding period (pcp). The Company recorded a net operating cash outflow of $1.5 reflecting the investment in working capital to satisfy the growing order book for existing and new products, notwithstanding the revenue of $8 million that was booked in the September quarter.

The Company’s total available funds at the end of the quarter are $4.9 million, which is made up of $3.1 million in cash and $1.8 million in available but undrawn debt. Beam believes it is well resourced to execute on its growth agenda outlined in previous announcements (aside from potential material M&A opportunities) and that its cash position will steadily improve over the course of the year as the working capital investment cycles back to cash.

Importantly, management notes that the Company’s use of funds is consistent with the objectives outlined in the November 2021 capital raising. This includes the launch of ZOLEO into Europe, development of the new Iridium Certus® device (which Beam has subsequently secured a US$12 million contract for) and the development of the ZOLEO API (launch is imminent).

Operating activities

Following the positive trading conditions in the quarter, Beam is well placed to deliver an FY23 earnings before interest, tax, depreciation and amortisation (EBITDA) in excess of $2.1 million, which is 40% above the previous year, and stronger margins, as highlighted in our August results release.

Of note, around $3 million worth of prepayments linked to the new Iridium Certus® device will revert to cash in the coming quarters. Beam commenced shipping this next-gen device to Iridium in the quarter.

The Company’s wholly owned SatPhone Shop (SPS) business, which is Telstra’s largest satellite dealer, recorded a 70.4% pcp increase in sales in 1QFY23, while sales of Beam Equipment (excluding ZOLEO) jumped 251% pcp.

Meanwhile, ZOLEO subscriber numbers continue to grow. ZOLEO’s net subscriber growth in Australia and New Zealand was recorded at 165% pcp, or 16% Quarter-on-Quarter (QoQ), to 4,337 as the September quarter is traditionally a weaker sales period for consumer satellite devices. The annualised royalty payment to Beam increased by 11% QoQ to $760,000.

The number of ZOLEO devices shipped and invoiced by Beam to the joint venture during the quarter increased by 17.5% pcp to 11,228 units. This takes the total number of devices Beam had delivered to the JV since ZOLEO’s launch in early 2021 to around 103,000 units.

Beam’s delivery schedule for ZOLEO extends through to 2024, with currently over 60,000 in open orders of the ZOLEO device. As lead times for orders is anticipated to improve from mid-2023, the joint venture will not need to put in new orders for the device until next year.

Additionally, the rebound in demand for ZOLEO in Australia and New Zealand post the pandemic has been more tentative than initially anticipated. Beam was initially aiming to secure 15,000 ANZ subscribers by the end of FY23, and this is now more likely to be achieved in late FY24.

Nonetheless, given the momentum in other products, Beam’s FY23 earnings outlook is not dependant on reaching the ZOLEO subscriber target within the original timeframe. Other products and general momentum will more than compensate based on the current order book and outlook.

The largest outflow of cash from operating activities are product manufacturing and operating costs of $5.9 million, which largely relate to the prepayment of components to buffer against supply chain disruptions, and staff costs of $1.5 million.

Investing and financing activities

Beam continues to invest for growth. During the June quarter, Beam capitalised $960,000 in product development costs relating to the new Iridium Certus® devices and ZOLEO product enhancements.

There was also a $220,000 outflow from financing activities with $162,000 of this related to a partial repayment of the interest free loan from Roadpost Inc. All repayments linked to this loan is completely at the discretion of Beam.

Yours faithfully,

Michael Capocchi

Managing Director

For media and investor enquiries please contact:

Brendon Lau

e: This email address is being protected from spambots. You need JavaScript enabled to view it.

m: 0409 341 613

About Beam Communications Holdings Limited

Beam Communications Holdings Limited is an Australian publicly-listed company (ASX:BCC) that specialises in the design, development, manufacture and distribution of satellite, cellular and dual-mode equipment applications and services. Beam has developed several world-first innovations and its products and services are adopted by some of the world’s largest satellite and telecommunications companies, such as Iridium, Telstra, KDDI, Inmarsat and Thuraya. Beam also developed the multi-award winning ZOLEO device, which generates recurring subscription revenues for the Group. Beam Communications Holdings Limited owns 100% of Beam Communications Pty Ltd and SatPhone Shop Pty Ltd www.satphoneshop.com. For more information, visit www.beamcommunications.com.

About ZOLEO Inc.

Formed in 2018 and headquartered in Toronto, Canada, ZOLEO Inc. is a joint venture between Beam Communication Pty. Ltd. and Roadpost Inc. that is pioneering the development of innovative lower cost, consumer-oriented global messaging solutions, including innovative wireless devices and apps based on Iridium short burst data (SBD), cellular and Wi-Fi standards. The company serves three primary markets including consumers residing on the fringe of cellular coverage, outdoor recreation and lone worker safety. Its products are offered through authorised retailers in the US, Canada and Australia. Roadpost is responsible for retail distribution in North America and Beam is responsible for the Asia Pacific region. Staged distribution in other regions will be jointly managed. For more information visit www.zoleo.com.